Asset Turnover Ratio | Analysis | Calculator

The asset turnover ratio is an efficiency ratio that measures a company’s ability to generate sales from its assets by comparing net sales with average total assets. In other words, this ratio shows how efficiently a company can use its assets to generate sales.

The total asset turnover ratio calculates net sales as a percentage of assets to show how many sales are generated from each dollar of company assets. For instance, a ratio of .5 means that each dollar of assets generates 50 cents of sales.

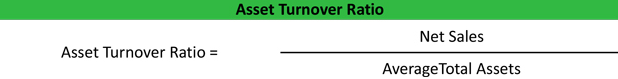

Asset Turnover Ratio Formula

The asset turnover ratio is calculated by dividing net sales by average total assets.

Asset Turnover Ratio Formula

Net sales, found on the income statement, are used to calculate this ratio returns and refunds must be backed out of total sales to measure the truly measure the firm’s assets’ ability to generate sales.

Average total assets are usually calculated by adding the beginning and ending total asset balances together and dividing by two. This is just a simple average based on a two-year balance sheet. A more in-depth, weighted average calculation can be used, but it is not necessary.

Asset Turnover Ratio Analysis

This ratio measures how efficiently a firm uses its assets to generate sales, so a higher ratio is always more favorable. Higher turnover ratios mean the company is using its assets more efficiently. Lower ratios mean that the company isn’t using its assets efficiently and most likely have management or production problems.

For instance, a ratio of 1 means that the net sales of a company equals the average total assets for the year. In other words, the company is generating 1 dollar of sales for every dollar invested in assets.

Like with most ratios, the turnover ratio is based on industry standards. Some industries use assets more efficiently than others. To get a true sense of how well a company’s assets are being used, it must be compared to other companies in its industry.

The total turnover ratio is a general efficiency ratio that measures how efficiently a company uses all of its assets. This gives investors and creditors an idea of how a company is managed and uses its assets to produce products and sales.

Sometimes investors also want to see how companies use more specific assets like fixed assets and current assets. The fixed turnover ratio and the working capital ratio are turnover ratios similar to the asset turnover ratio that are often used to calculate the efficiency of these asset classes.

Asset Turnover Ratio Example

Sally’s Tech Company is a tech start up company that manufactures a new tablet computer. Sally is currently looking for new investors and has a meeting with an angel investor. The investor wants to know how well Sally uses her assets to produce sales, so he asks for her financial statements.

Here is what the financial statements reported:

- Beginning Assets: $50,000

- Ending Assets: $100,000

- Net Sales: $25,000

The total turnover ratio is calculated as per formula:

As you can see, Sally’s ratio is only .33. This means that for every dollar in assets, Sally only generates 33 cents. In other words, Sally’s start up in not very efficient with its use of assets.

Fixed Asset Turnover Ratio

Fixed-asset turnover is the ratio of sales (on the profit and loss account) to the value of fixed assets (on the balance sheet). It indicates how well the business is using its fixed assets to generate sales.

Generally speaking, the higher the ratio, the better, because a high ratio indicates the business has less money tied up in fixed assets for each unit of currency of sales revenue. A declining ratio may indicate that the business is over-invested in plant, equipment, or other fixed assets.

Fixed Asset Turnover Ratio Formula

{\displaystyle Fixed\ Asset\ Turnover={\frac {Net\ sales}{Average\ net\ fixed\ assets}}}

![]()

In A.A.T. assessments this financial measure is calculated in two different ways.

1. Total Asset Turnover Ratio = Revenue / Total Assets

2. Net Asset Turnover Ratio = Revenue / (Total Assets – Current Liabilities)

Asset Turnover Ratio Calculator

The higher the ratio, the more sales that a company is producing based on its assets. Thus, a higher ratio would be preferable to a lower one. However, different industries can not be compared to one another as the assets required to perform business functions will vary. An example of this would be comparing an ecommerce store that requires little assets with a manufacturer who requires large manufacturing facilities and storage warehouses.

Another breakdown for the formula for turnover ratio is companies that are using their assets now for future sales. This may be more of an issue for companies that sale highly profitable products but not that often.

An example would be comparing two companies within a single industry where company A made 2 sales this year and company B made 1 sale, but expects to have a contract for 10 sales the following year due to spending a large amount in research and development this year on a new product. Of course, company A’s expected sales next year is unknown, but it is possible that company B may still be a more profitable investment, assuming it maintains its short term solvency. This issue may apply, in general, to all companies, but the more that 1 sale makes a difference, the larger affect there will be on the formula for the turnover ratio.